Get paid to do what you love! Be your own boss!

Starting a new business is exciting but can also be challenging and risky. With our help, you can minimize the risk and easily get started! This article is written for entertainment and is not legal advice. See the disclaimer at the end of the article.

Why a fabrication business?

There are many different small businesses, from home cleaning to engineering consulting. Fabrication fits right in the middle of those in terms of expertise and expected cost. One great thing about a professional fabricator is that they don’t require a formal degree or certification. Your existing experience and skills may already be enough for your new business. Another huge benefit is the rate you can make per hour. Unlike many other trades like daycare, plumbing, and home repair, fabrication work often doesn’t have a set hourly rate your customer expects to pay. Furthermore, your customer will not know how many hours you spent on their project, allowing you to bid a flat rate for work and complete it at a pace that is rewarding for you and your customer.

With proper research and experience, you can work efficiently with the right tools and achieve very high pay rates. For example, running a $200K CNC milling machine can yield $300-500 per hour in revenue, but it takes years to learn (and the machinery costs a small fortune to buy). You can generally plan to bill about ~$150 per hour for welding and about ~$300-400/hr for tube bending in a production run. The equipment to weld and bend tubing costs less than 10% of what a CNC mill would cost! Fabrication and metalwork are in demand nearly everywhere, and the rates paid to owners and fabricators are incredible.

This is a photo of Joe Gambino’s 1988 Toyota 4Runner crawler and business show-off-rig. Fifteen years ago Joe wanted a tubing bender to build some projects, but didn’t like what was for sale on the market. He loved making sparks in the garage building off road toys. He made his first prototype tube bender in 2012. Fast forward a few years, and his company (the web page you’re on now, Rogue Fabrication) has 10+ employees, annual sales measured in millions, and has filed more than 20 patents and trademarks for it’s products.

What should my business do?

While we can’t answer this question for you directly, we can help! If you are reading this article, you likely already have a passion for fabrication. You should find the overlap of two categories: Things you are good at and things that are in demand in your potential service area. For things you are good at, this may be experience from your regular job. Be ethical and abide by any non-compete clauses that are in place if you ever consider going into competition with your past employer. Things you are already good at could also include your hobbies, like restoring motorcycles or building cross carts/karts. Things that are in demand in your service area mean you will have to do some initial marketing work (which we explain later in this article). Your service area simply means the area you plan to serve. For services like welding, this is likely going to be a close driving distance, like a 50-100 mile radius from your shop. For any product you can ship, this can expand to the whole country or worldwide. It is up to you. We mention products you can ship because many businesses that start out as a “job shop” eventually find a niche and are able to fabricate products in some type of bulk like 5 or more at a time and keep them on hand until sold. A job shop is any business that does work for customers one job at a time. While these jobs can be for bulk where you are actually manufacturing, we consider this to be low volume where you aren’t building anything to keep for yourself as inventory as you try to sell it to your customers. Once you build and stock products, we call that a transition into light manufacturing.

Jared Sams – M600HD in use at Buxton’s Fab & Dab in North Carolina. Buxton’s does a wide range of custom fabrication, but specializes in side-by-sides and motorcycles (among other tube bending projects).

Can I start this by myself? With a small team?

You can run a fabrication shop as a one-man (or woman) show. You can start in your garage, run a mobile service out of your truck or trailer, or rent/buy shop space and a growth plan. A good mantra for a new business is “Keep it small, keep it all,” which is the opposite of “Go big or go home.” When you keep things small, you focus on what you know how to do well, which minimizes risk. You also reduce the range of equipment you need to buy, reducing your investment. While these will limit the jobs you can bid on, it will also make you more likely to land the jobs and keep them profitable. As your business and experience grow, you can decide with good judgment where to expand your tools and services.

Similar to many other businesses, you can scale a fabrication business if you have enough work. You will add tools and workers like any other business and figure out a sensible ratio for employee hourly pay rate vs billable rate. As an example, let’s say you can hire a moderately experienced fabricator for $28/hr in your area. If you are bidding jobs at $150-400 per hour, you are earning a multiple of 5.3 to 14.3 times that person’s base wage. After you factor in shop cleaning, benefits, and some overhead, you still have a lot of room for bottom-line profit to the owner(s).

Casey Oswald – M605 in use at Protolite Racing in Lake Lillian, Minnesota. Protolite makes Cross Cart parts and sells complete sets of plans so you can build your own!

What tools do I need?

This is a very important question to ask yourself. The answer depends on what your business will do in terms of services or manufacturing. No matter what tools you have, you will likely have a network of suppliers you depend on for processes that you cannot do within your own shop (like CNC machining, laser cutting, nickel plating, etc). If you are ever adding a piece of equipment, you should consider the ROI (Return On Investment). Most businesses consider ROI to be summarized by a break even point when the machine has paid for itself. To figure this out, divide machine cost by profit or savings. If a machine costs $76K and saves you $374 a month in labor, this is 76000/374, which is 203 months. That is almost 17 years, so don’t buy it! If you can’t see positive ROI (more savings than the machine cost) within 2 to 3 years, you likely need more jobs/work to do, or you haven’t found the right piece of equipment to buy!

This is a photo of Brandon (at RogueFab) welding up a control arm for our shop project race car, a ~450HP twin turbo 1972 BMW 2002 that is running suspension from a 2000’s era BMW 3 series. We’re welding brackets on for forged monoblock Mercedes CL600 rear brake calipers to run a dedicated secondary hydraulic E-brake caliper for those days at drift events (because why not?!).

Here is a general list for average metalworking and fabrication operations and the necessary tools:

Basic Fabrication of Steel: You are going to need hand tools, and small hand power tools like sanders and grinders. You will need a way to cut metal to length like a bandsaw. You will also need a welder. Unless you don’t plan to drill holes, getting a drill press is a must. There are affordable MIG welders out there for less than $1000 that can be used in a business setting. You can also go for a more industrial grade welder (like Miller/Lincoln/etc) for about $1800. You can also get a handheld plasma cutter (or oxy acetylene torch) for a few hundred dollars to cut profiles and curves.

Basic Fabrication of aluminum or stainless: This adds the requirement of TIG welding in most cases, and will basically double the cost of the welders described above. Aluminum will usually require AC (alternating current) for the welder power source type.

Moderate Fabrication: We consider moderate fabrication to be getting into cold-working of metals. This means you’re bending them to a point that they don’t bend back. The 2 most common ways customers will want metal to be bent will be having straight folds in sheet/plate or having hollow structures (tubing) bent.

For putting bends in plate or sheet, you are going to use a press brake for tight radius bending (much more common), or a roll for large radius bending (more expensive and less common). Our company (Rogue Fabrication) sells an affordable Made-in-USA shop press that has CNC press brake capabilities without the common drawbacks of a press brake (like part height limitations). There are plenty of alternatives including imports that we compete with.

For putting bends into tubing, you will use a tubing bender (for tight radius bends) or a tube roller (for large sweeping bends). Like the small and large bends in plate/sheet, the large radius bending in tubing is generally more expensive and in lower demand. Our company also has been making affordable and accurate tubing benders here in the USA for more than a decade. We also make a mandrel bender which adds an internal support to the tubing being bent, which allows better bend quality, tighter bend radii, and thinner wall material to be bent. We have a lot more info about tube bending and design considerations in our tech index LINK here

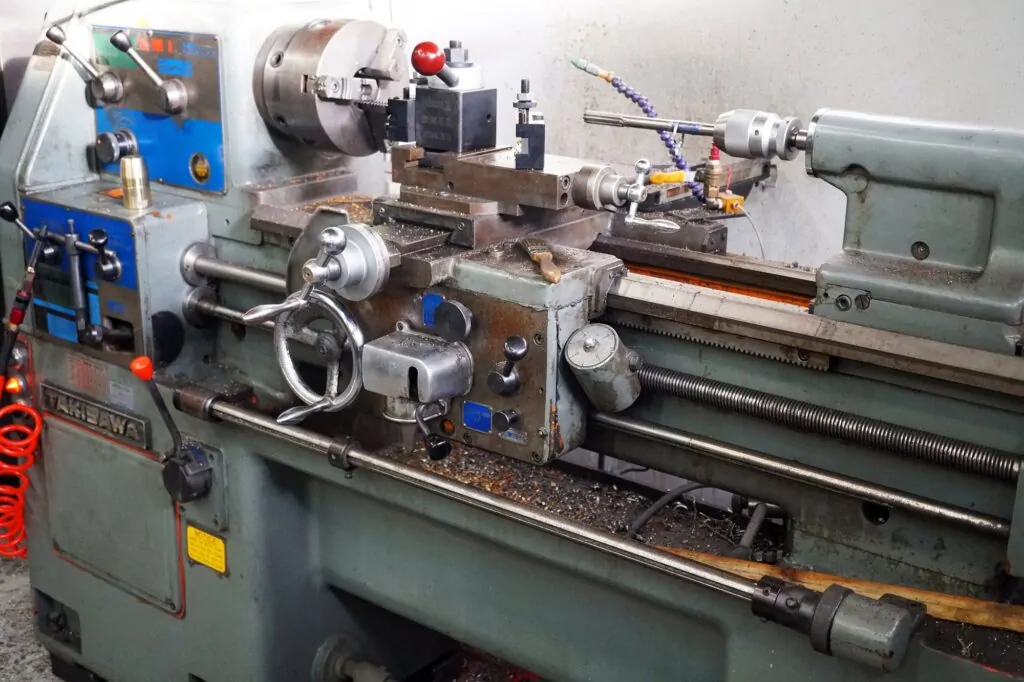

Advanced Fabrication: Once you want to get into more advanced fabrication or want to make more profit by bringing processes inside your shop (like cutting or machining you used to send to other shops), you will likely start looking into buying more expensive machinery. That machinery is likely going to be a milling machine, a lathe, and/or a CNC profile cutting table.

Mill: most people start with a knee mill (like a Bridgeport, Sharp, Acra, etc). These mills are $1-4k used or $15k+ new. They are used for machining just about anything that isn’t round. They look like a huge drill press on steroids with a large table that moves in the path of a cube (X, Y, Z). We will likely have separate lessons on how to shop for and buy these… There is a lot to learn!

Lathe: A lathe makes round parts and they are commonly made by companies like South Bend, Lablond, Monarch, and others. They will set you back about $2-4k used or $10k+ new.

Manual vs CNC: You can also start with CNC equipment, but they are more expensive and require a lot more space and power compared to manual mills and lathes. You can run a manual lathe or mill on a VFD (variable frequency drive) to make your own 3 phase power off your single phase home or shop electrical panel for about $100, making manual machines even more sensible for a small business compared to large CNC equipment. Some small CNC mills and lathes also exist that run on single phase power, though they are more expensive for what they do (look at Tormach, Haas, and others). They are usually at least $10k used if they work, and $20-60k new with options.

Profile Cutting (CNC): Plasma tables dominate the small business area for CNC profile cutting. They are relative cheap (under $20k new in most cases), but the cut quality and sensitivity to wear and environmental factors leave a lot to be desired with compared to the alternatives. Laser cutting machines and water jet cutting machines are going to produce sever times better cut quality in most cases, and usually do so with far less maintenance and adjustments to keep the cuts in spec. If you are reading this and already have a plasma table, please don’t be upset. There are some people who have great skill and are able to reliably attain amazing cut quality with nearly no kerf and vary low maintenance. You may be one of them! For everyone else, spending $80k+ on a laser or water jet is the way they are going to see manufacturing-level results. Keep in mind that most CNC plasma machines run on single phase power, and most lasers and water jets require 3 phase! These machines go hand-in-hand with a press brake. They are an incredible combination.

Other Machinery: You may find that you need to do a volume of work that doesn’t fit into this list of machinery. If you do a ton of forming or hole cutting, an Iron Worker may be what you need. They are tough to find used for less than $8k, and the tooling that goes in them can cost more than the machine in a hurry! New they are usually $20k+, and a lot of them require 3 phase power. Many ironworkers have attachments to bend and notch tube or to be a press brake. These attachments are usually very limited and are best done by stand alone tools in our opinion. Another popular piece of machinery is a CNC tube notcher (or tube plasma). These are usually $75-100k and are really cool, but most be put in perspective for their return on investment. Consider how much time it will save you and how much it costs. You find faster ROI on other machinery.

CNC plasma table cutting thin gauge steel (close up).

Are there steps to follow to get started the right way?

There are some things you must do before you accept your first job and plenty of things you should (but don’t have to) do. That is okay if you don’t know what your business will begin offering (or specialize in). Once you read through this article, you will likely have a few ideas. Here are the steps in order:

1. Pick a business name and register the web page

Business Name: Start thinking about this now. If you can’t figure one out, don’t worry about it! You can come back to this later. You should pick something that doesn’t limit you to a narrow scope of business. For example, if you are great at TIG welding stainless steel from a job as a pipe fitter and plan to offer welding, maybe you will think that “Donnie’s Stainless Steel Welding” would be good, but it is not. People who want a race car chassis, side-by-side repairs, or a custom gate might not think you can help them. Consider something more like “Precision Metal Work by Don,” which also puts search-relevant terms ahead of your name. Your customer’s success should always come before your name in your marketing (if possible). This name is also universal to all things metal. Replacing “metal” with “fabrication” would further broaden the name. Also, “precision” will let your customers know you may not be the cheapest place in town, but you’ll likely get the job done right and exceed their expectations on the first try.

Web page: 4-letter domains are the most sought-after, so they are not as readily available. Try to keep it as short as possible. Generally, using words with around 10-16 total letters is the sweet spot. You can go anywhere that will register your domain to see if the one you want is available. One of our favorites is GoDaddy, which will cost you about $20 annually. If you type in a domain and it is already in use, they will offer you a lot of money to buy (usually for $3k or more). You absolutely 100% do NOT need to spend thousands on a web address to succeed. We don’t recommend this at all. We do recommend you stay within the “.COM” range. Getting other extensions like “.net/.org” will generally confuse consumers. If they offer an e-mail service, we recommend that you get one. It will cost you about $20 a year and allow you to put “sales@precisionbydon.com” on your business card instead of “precisionbydon_1992@gmail.com”. Nothing says “I’m not invested in my success or your project” like a generic e-mail domain. If you love Gmail, there are ways to use it to read your private domain e-mail. We’ll explain in a later lesson.

2. Register your business in your state/country/etc.

Your state or country may vary, but most U.S. states are similar to Oregon. Type “Michigan SOS” into a web search (using your state’s name). SOS is Secretary of State, which is the office that organizes and regulates businesses in your state. On their web page, find the link that says “register a new business” or similar. You must choose an entity type (entity just means “thing” or a business in this case).

Most small fabrication businesses will be LLCs (Limited Liability Companies). One or more people can own an LLC, have various tax structures, and have low maintenance requirements. Other options generally include corporate structures and proprietorships. You can follow the instructions using the name you picked out and fill out the forms required online, and you will pay about $100 to register your business this way. If you are unsure about this process or which entity type you are, you can consult a business law firm that can file all this for you, but it will cost more. Once you register, nearly everything you type in will be public information, which is when you need to consider if you want your cell phone, personal e-mail, and home address tied to your new business forever. There are ways around all 3 of those, and we will go over those in later lessons. If you’re outside the U.S., you’ll have to figure out business registration on your own.

3. Get a business bank account

You will look like a hack if you use your personal bank account. Go to your bank of choice. Business checking should be FREE. Also, a Limited Liability Company (LLC) should have all its assets for the LLC separate from personal assets. If they are not separate (like money in your personal bank account), any mistakes you make may have to be “fixed” using the same blend of business and personal assets you run the business with. In higher legal terms, your separation of personal and business liability can compromise you if you don’t separate these things. Do not skip this step. You will use the same business name from step one.

Jason Duckett – M605 in use at Iron Duck Fabrication in Watkinsville, Georgia.

4. Brand your business

Logo: Unless you’re skilled in digital art, hire someone for this. Our favorite places are Upwork, Fiverr, or your local community college (find the marketing students; there will be bulletin boards where people are selling this work). Nike paid about $50 for the swoosh a billion years ago. That is about the same rate you will pay for your logo. Complex and shaded logos do not scale or print well on various media (like shirts and hats). Do with that information what you will.

Business Cards: There is no need to go into debt to create business cards. You can get business cards from Vistaprint (or their competitors) for about $50-100. Keep them SIMPLE. Ensure they have your business name, phone number, and city/state. The full address is up to you, but it makes you appear more sincere/serious. Your card should also state your trade or services.

Clothing: Don’t prepare to roll a cart of branded junk down the street in a parade. You should consider either hats or shirts. One of these items will set you back about $20 per shirt (or hat) if you buy 10-20 at a time, which is completely optional but will help you look professional when you talk with customers.

Vehicle branding: Put down your phone. You are not buying a $5K wrap for your truck today. If you work exclusively mobile from your truck or trailer, consider a cut vinyl logo for your vehicle, which is different from printed vinyl (which usually means a full-color design printed directly onto the material). A local shop or someone on Etsy can do a one—or two-color cut vinyl for you for $20-150, depending on size (from small up to several feet wide).

Evan Hodges – M625 in use at MF Marine Fabrication in Virginia Beach.

5. Register other accounts and security

Accounts: This is boring but worth the time. If there is any chance that you will use social media or videos to market your business, register those accounts. These will likely include Facebook (register as a business, not a person), Instagram, YouTube, etc. Remember that you can never edit your YouTube e-mail if you register using a Gmail domain (since Google owns YouTube). If you use a non-gmail domain, you can transfer it later if you ever need to. These are all FREE to register.

Security and scams: People will try to steal from you faster than you make money. We encourage you to use 2FA (two-factor authentication) whenever possible. Don’t be a fool and fall for phishing scams (fake login or other data-stealing attempts). Also, when a customer is in a hurry and willing to pay extra, that is a common way for a thief to appeal to your greed and optimism. Be careful. Most thieves will not call you. They also usually won’t answer if you call them. Call your bank if you ever “get paid” and someone made a mistake and needs a refund immediately; this is nearly certainly a scam. Another super common one is “Nigerian fraud,” where someone overpays you and gives you contact info for their shipper, whom you are supposed to get a quote and pay directly. Big shock here. The shipping company will be one that you usually haven’t heard of, and they will have a weird e-mail address and will reply to you with a quote remarkably fast. It is a scam to get that real shipping money from you after they make a fake payment.

6. Prepare to collect money

Your methods will vary based on your business model. The most significant variation is generally between web-based sales (called e-commerce or “e-com”) and in-person sales.

E-com: This can be very, very simple or very sophisticated. Following our steps, you don’t have a web page built yet. We can teach you how to build one without hiring someone, but that is beyond the scope of this article. You can sell things to your consumer pretty easily using eBay (commission will be about 17%) and Etsy (~15% commission), or you can hit YouTube and learn to set up your e-commerce storefront like we did years ago (~2.9% in processing fees only). Your registrar (fancy name for the company where you registered your web page or domain name) will likely have a built-in web page builder, which is usually rough but a great way to get your name on a super basic web page. Hence, your customers see that you exist. Your basic web page can say, “Call us to order,” you can use the in-person sales methods below to make the sale without huge fees.

In-person sales: You need a POS system. POS is Point-of-Sale. POS is like a cash register. We recommend you do two things:

- Pick out a credit card system. We started with Square about 15 years ago. Back then, running a card cost about 3.5%. You could slide them through a free reader on your phone or type the numbers into an app that linked to your business checking account you made in Step 3 above. There are several competitors for this service, including PayPal Here and others. We have no affiliation with any of them. You do NOT need anything with expensive hardware or a subscription fee! Don’t waste your profit here.

- You need a cash drawer. Just type “locking cash drawer” into any place where you buy things online. You can get a very good one with spring-loaded levers to hold cash down for under $100. If you think you will get away with a plastic tote, plastic bag, cash in your pocket, or a wallet, think again. Those will make you look like a hack. Put enough change in the drawer to break a $100 bill twice for a small transaction. Lock or screw it to something heavy, like a bench or table, if you like.

6. Marketing and Sales

Marketing and sales are dependent on your business type. You can start with friends and family or your professional network. A simple way to do marketing is to call your competitors. Ask them what their lead times are. If a local welding/fab shop that does nothing but RZR/side-by-side cages is 6 months out for new work and the shop that builds gates has a “same day install special,” you might consider offering services that appeal to the side-by-side market. Following that example, figure out where that group of people goes to find shops offering fabrication work; this is likely to be a trade show. For side-by-sides, their trade shows frequently are “fun, show, and ride” types of events. Good examples are local races, dune events, hill climbs, mud bogs, etc. These usually have a “vendor row” area where businesses typically pay $50-500 for a 10×10 or larger booth space and market/sell directly to the end users and local businesses. We have done a lot of show marketing and know how to do it extremely well. You can show up with folding tables and a generic pop-up shade and look like you have no idea what you’re doing for about $250 in equipment. Alternatively, you can spend about $1500 and look like a professional traveling marketing team for a corporate-level business. We will go over this in more detail in later lessons.

Fowler Gregerson – M625 in use at Bump It Off-Road in Windsor, Colorado.

6. Long-term considerations: Income and Sales Taxes

Tax firms can handle every single part of this section for you. Read on if you want to be thrifty and manage it like we do!

Income Tax: You can file taxes for an LLC as a pass-through entity on your personal federal (and likely state) taxes. Tax filing will vary by state since some states do not have an income tax. We’ll explain with an example. Let’s say you make $50k at your W2 day job, your LLC brings in $20k in revenue, and you spend $5k on materials and other write-offs for the LLC in a given year. You will likely have an accountant firm or an online automated tax system do your taxes just like you currently do. What they do (without showing you) for this case with your LLC is extremely simple. They fill out a federal form 1040 like nearly everyone in the U.S. already has filled out for them by their tax preparer. The software (or person) will ask you about expenses and income from your LLC, which will go onto Form 1040 Schedule C (business income). Your revenue will be $20k minus your expenses of $5k for taxable income of $15k. That will go on a line of your 1040 as taxable income. Your income is now your W2 job plus your LLC, which is $75k. You will owe taxes, but your W2 job likely had taxes withheld so that it will be a tax rate based on your total income, applied to only the income added by the LLC. The same is true for your state in most cases since their tax forms process is usually about the same as the federal one. If you are making money and don’t want to pay penalties and interest, figure out your federal tax rate here: US Federal Tax Rates (Link) and save that percentage of your profit from your LLC. Once per quarter, you will make estimated payments to the IRS. The whole process is described with links to resources here: US Federal IRS Estimated Tax Process (Link). Your state will have similar processes/documents if they have an income tax. If you have a paid tax preparer (like an accounting firm), they will be happy to do this simple math and tell you exactly when to pay estimated payments and how much to pay. If you skip estimated payments, you will owe more at the end of the year. If you file your taxes honestly and on time, this isn’t the worst thing. The fees for paying late (skipping estimated payments) are frequently less than the penalty for filing your taxes late. Growing your business and caring for your customers may be more important and valuable than making a few hundred-dollar estimated payments on time.

Sales Tax in your state(s): Most states have sales tax. Your requirements will vary by state. Look up the requirements on your Department of Revenue or Secretary of State web page. You will nearly certainly have to collect sales tax (on sales to your customers) from day one in the state where you do business. Sales tax is collected because you physically exist as a business in a state with sales tax. The same applies if you travel to another state during the year to personally deliver (in your vehicle) or sell goods and services. Traveling out of state to sell your products means you must be careful about where you do business. If you cross a state line this way, you now exist as a business and likely have to charge/pay sales tax in that state indefinitely. When you are buying things for your business, you may have to pay sales tax. Many states with sales tax have exemptions for businesses when they are either buying inventory they will sell, buying production tools, or both. In most states, you will need to file for your tax exemption before making a purchase for the transaction to be tax-exempt. You will want to keep tax exemptions on file for any of your customers who claim tax-exempt status (this is to protect YOU, as tax fraud is incredibly common).

Out-of-state sales tax: This is tough initially, but it’s more manageable as your business grows (due to automation). All states that collect sales tax have their definition of when a business that ships products to their state must pay sales tax, which is called “nexus.” You have nexus once you meet that state’s criteria. Nexus is unlike the paragraph above, where you physically drive to another state to do business or deliver. We’re talking about you shipping to another state using the postal service, UPS, FedEx, etc. These requirements vary by state but are commonly several transactions per year (like 100, for example) or a sales volume (like $100K per year shipped to a single state). These nexus rules vary by state and are listed here: https://taxfoundation.org/data/all/state/economic-nexus-by-state-2024/. In our experience, most states want not to be ripped off. If you are trying your best, that is likely good enough. If you register a month late after crossing their nexus threshold and start collecting and paying sales tax, they will likely not try to impose fines. Once your business grows (as ours has), your e-com solution will include built-in automation to calculate, collect, file, and pay state sales tax. It is extremely easy.

Zero sales tax: When no sales tax is collected at the point of sale, consumers often believe they do not have to pay tax at all. The customer’s state tax agency requires out-of-state sales reporting and taxes collected. Many consumers underreported this (committing tax fraud), and the states turned on businesses to collect the tax to solve the giant income deficit. When a customer is on the phone and asks you, “Is this tax-free?” your answer should be, “We are not obligated to pay sales tax to your state yet, so we will not charge you tax. I cannot advise you on your tax liability in your state”. We all know they are supposed to claim the transaction in this case and pay taxes to their state, but a business can’t force them to do that and certainly shouldn’t tell them they don’t have to.

Cost of mistakes: If you establish nexus in a state and don’t pay taxes there, they will likely eventually find out. When they do, they will do a relatively simple audit. If you don’t participate in the audit, they will make broad assumptions and send you a bill for taxes and penalties. If you participate in the audit, you’ll get the same bill (but for the correct amount, usually lower than their assumptions). If you don’t collect tax from your customers, that has nothing to do with you owing it to the state they live in where you shipped the product. That means you could owe taxes for years of transactions that you never collected taxes on. It is good that most states have very high nexus thresholds (for example, California’s threshold at the time of this article is $500k annually). That means you could sell $400k just to California for years without having to collect and pay taxes for their state, giving you ample time to plan for participation in their sales tax system.

Jared Sams – M600HD in use at Buxton’s Fab & Dab in North Carolina.

Tips and tricks:

1. Reputation

Your business reputation is your single most valuable sales tool. Following these simple steps, we have developed an incredible brand reputation. You can start by making a Google business listing (also called “Google My Business”). Customers can leave reviews here, and you can also add the information from your business card here.

A. The customer is always right: this is an oldie, but it’s nearly perfect. Unless your customer is going to put you out of business with their insane demand, just give them the stupid bolt and nut that they lost or stripped. It isn’t worth the fight and the negative review.

B. Be honest: you will get caught if you lie. If your powder coat is running late because you had to help your sick family or something, let your customer know that the powder coat is late. You can say it’s your fault or not. You don’t need to tell them about your family. They do not need to feel sorry for you to understand that the schedule slipped.

C. Listen: Write down their name. Call them by name. Thank them for calling or coming by and figuring out what they do (race cars, build fences, etc.). Cater your sales pitch to their needs.

D. Lose money when you deserve it: If you under-bid a job, you can ask for more money at some point. If you screw up and have to pay to fix it later, you likely can’t ask at that time. And if you have a product warranty, shipping damage,e or similar issue, you may spend more fixing it than you made in profit on the sale. These can all lead to you having a business transaction on which you lose money. Many business owners will be unable to handle this, blame others, charge without permission, and leave the customer without 100% of what they purchased, or worse, which is a short-term gain and a huge long-term loss. You will pay for it tenfold in bad publicity. Make it right, and ask, “What else can I do to make this right?”. Learn from your mistake and never repeat it.

E. Reviews and SEO: Ask for reviews and photos from your customers. Take photos of your work. Post the reviews to your web page as you develop it. You will eventually have to learn or pay for SEO (Search Engine Optimization) if you plan to leverage the web for leads or e-commerce.

Michael Childers – M625 in use at Chilli Welding and Fabrication in Middleton, Ohio.

2. Debt, Cashflow, and Growth

Debt: It takes money to make money. You don’t need to pay massive debt to start a metalworking or manufacturing business. The less debt you have, the lower your minimum monthly profit when making loan payments. Identify the machinery and tools that will make the most monthly profit or produce the income to cover their monthly payment in the least time (with jobs you can get into your shop). Those are the tools to buy. Like a credit card, consumer debt will have interest rates of around 20%. Business credit will have a higher or lower cost, completely dependent on the situation.

If your business grows fast, it may not produce any cash flow at all. In the case of a service-heavy business, this isn’t true. In a make-and-sell business, it is very true!

Growth and Cashflow (service or job shop business): Let’s consider a service-heavy business that is growing and doubles in sales. You collect double revenue when your business doubles, and your labor costs increase accordingly. You haven’t invested anything to eat up the additional cash coming in, and your doubled revenue will result in double the net income. You may buy more consumables and other items, but you’ll still be cash-rich, meaning you will have more cash in the bank than you had last year.

Growth and Cashflow (manufacturing business): This is the opposite (of the above growth example for a service-heavy business) if you manufacture products to keep as inventory. Let’s say you generate $50k of sales in year one with $25k in inventory, and you sell your inventory for exactly double what you pay for it. The following year, your sales increase, and by the end of the year, you’ve sold $100k. During that time, you will have spent $50k just replacing the inventory you sold, but you’ll likely want the same ratio where you have half of your annual sales in inventory value. That means you will also have ordered another $25k in inventory to bring your total up to $50k in inventory. You have now brought in $100k in sales and spent $75k in inventory, which sounds terrible, but you didn’t sell all the inventory. You doubled what you had on the shelf, which you get to make money selling later. The cash flow problem is that the cost of goods is deducted from taxable income when sold, not when you buy it. So you will pay taxes on the income minus the cost of your sales. You don’t get to subtract the extra inventory you bought until you sell that inventory, meaning your taxable income will be $100k minus the $50k cost of goods sold. At a 30% tax rate (as an example), you will owe $15k in taxes (.3 times $100k-50k). Now, for the year, you have $100k in sales -$ 75k in purchases – and $15k in taxes = $10k net income. This means that you will likely have less cash in the bank this year than you had last year, despite your business growing! This is a challenging example, and it is before any potential increased costs, which would erode this cash even further. A business that doubles every year is not a cash cow; it is a cash hole! Very few enterprises grow this fast, but this is a great example to help illustrate why a healthy manufacturing business can struggle to produce healthy cash flow until growth slows down and stabilizes.

3. Have Fun!

Being your boss is very freeing. You can choose what you want to do for your business. If you love metal art, that is what you get to make and sell. If you love building custom bicycle frames, you get the idea. Make sure you take joy and pride in your business, and delivering satisfaction and value to your customers will be easier.

Businesses our customers have started: We have seen customers of ours buy machinery from us (like a tubing bender and notcher) and go into roll cage fabrication, which affords them the opportunity to work on extremely cool projects and do what they love, while having a flexible schedule and excellent pay. We have customers also staying very busy in marine fabrication. Marine work usually is done with anodized aluminum and stainless steel for corrosion reasons. The projects are usually done on boats if they are large, so being near where boats are moored is important. There are very few industries that allow higher billable rates in tube fabrication than the marine industry. General construction includes tons of handrail work, which is again usually done on site (at the building). These jobs pay very well too. The largest area we see tube fabrication in is motorsports. This is a broad range of racing and recreational projects includes (but is not limited to) drag race cages, drag race chassis (SFI, NHRA, or others), Road race chassis and cages (NASA, SCCA, FIA, Lucky Dog Series, 24 Hours of Lemons, or others), rally race car cages (FIA or other), side by sides (RZR, Maverick, others), desert (trophy or prerunner) trucks, and an etirely new class of inexpensive off-road toys… Cross Karts! Cross Karts are a fast expanding market of primarily home-built carts that are usually rear wheel drive and single seat. Some dual seat (side by side) examples also exist. You can buy plans for these to build yourself for less than $5k in parts, or spend up to $50k and buy a turn-key racecar that will completely waste any stock side-by-side on the market in nearly any competition. There are also many sanctioned races being created all around the world cor cross carts as the need for safe and inexpensive racing emerges worldwide.

Fowler Gregerson – M625 in use at Bump It Off-Road in Windsor, Colorado.

Disclaimer: This is NOT legal advice. We provide this opinion solely based on our experience and strongly recommend that you consult certified experts in the respective field before making any decisions about these topics. Our terms, conditions, exclusions, and agreements linked throughout this webpage apply to this article and its context. We are not responsible for the content at any of the links within this article. If our terms and this article are contradictory, the terms of our web page supersede this article.